Are you worried that your customers may fall victim to online payment fraud? Then, you’ll need to invest in various online payment fraud detection methods that will help combat the problem.

Investing in fraud prevention systems boosts your brand’s credibility and customer shopping experience.

In this article, we’ll share commonly used strategies by brands to combat online fraud. We’ll also share why machine learning is becoming an increasingly attractive choice for businesses.

Then, you can decide if it’s the right choice for you in the pursuit of getting rid of scams like identity theft. So, without further ado, let’s get started!

Table of Contents

Online Payment Fraud Detection: How To Protect Your Business

You can implement several strategies to improve fraud detection in online payments. This will boost the trust that customers have in your website.

Here are the top fraudulent transaction protection strategies:

- Implement strong authentication measures: Require customers to use multiple forms of verification, such as a password and a one-time code sent to their phone or email. This significantly boosts your login protection, which will minimize instances of online payment fraud.

- Use advanced fraud detection tools: Deploy machine learning and artificial intelligence tools. These must be able to analyze transaction patterns and detect anomalies in real time. Additionally, the tools must monitor user behavior on your site to identify unusual activities that could indicate fraud.

- Secure your payment gateway: Make sure you encrypt all transactions using SSL/TLS to protect data in transit. Furthermore, you need to adhere to the Payment Card Industry Data Security Standard (PCI DSS). This ensures a high level of security for credit card transactions.

- Monitor transactions in real-time: Set up real-time alerts for suspicious activities. These can include large transactions, multiple transactions in a short period, or transactions from high-risk locations. Additionally, you’ll need to have a team or system in place to review flagged transactions for additional verification manually. A fast verification system reduces the chances of customer frustration when transactions are on hold.

- Educate your customers: Take the time to educate your customers about common fraud schemes and how to protect their information. You’ll also need to encourage customers to use secure internet connections and regularly update their software. Friendly fraud prevention reminders are good practice for any business, and it shows that you care.

What Is IP Address Fraud?

IP address fraud is a type of cyber attack where an attacker manipulates the IP address of a device to masquerade as another device on a network. This is also known as IP spoofing or IP address spoofing.

This allows users to mimic the location of legitimate users to gain access to a system or make payments in this context. Therefore, blocking IP addresses doesn’t ensure that you can block transactions from these users.

Top Benefits of Online Payments Fraud Detection With Machine Learning

Do you want to know the top reason to use online payments fraud detection with machine learning? Machine learning is making it harder for criminals to get away with fraudulent online transactions.

Here are the top reasons to incorporate machine learning into your website security protocols:

- Real-time fraud detection: Machine learning algorithms can analyze transactions in real-time by identifying and flagging suspicious activities immediately. This instant detection helps in preventing credit card fraud before it takes place. This means you can improve the overall customer experience of the shopping experience for buyers.

- Improved accuracy: Machine learning models can accurately distinguish between legitimate and fraudulent purchases. This is especially true when machine learning systems have had a chance to work on large datasets. Hence, they reduce the number of instances in which a valid transaction gets flagged.

- Adaptive learning: Machine learning models continuously learn and adapt to new fraud patterns, which is unlike traditional rule-based systems. Therefore, they can update themselves based on new data. The result is a more effective system for detecting different types of payment fraud.

- Handling large volumes of data: Machine learning systems can process vast amounts of transaction data efficiently. Therefore, they can analyze multiple variables and complex patterns that are beyond human capacity. This ensures thorough scrutiny of each transaction.

- Lower operational costs: Machine learning reduces the need for manual review of transactions by automating fraud detection. This automation cuts down on labor costs and allows fraud detection teams to focus on more complex cases.

Why the Online Payment Fraud Detection Dataset Matters

The online payment fraud detection dataset is important since bigger datasets lead to better training for machine learning models. Ideally, you’ll want to make use of machine learning models exposed to large datasets.

This ensures they will be more accurate in uncovering future fraudulent events. Financial institutions may share large datasets to help with the training of these security machine-learning models.

Top 4 Digital Fraud Detection Best Practices

Do you want to implement the best practices for your digital fraud detection systems? Then follow the advice in this section, and you’ll hit the ground running.

These four strategies have proven to tighten security for some of the biggest websites on the internet!

1. Leverage Advanced Machine Learning Models

One of the best things that you can do is leverage the power of advanced machine learning models. They can solidify your online payments fraud detection systems by improving automation and accuracy.

However, you’ll need to pick a service that offers an excellent machine-learning model for the job. Make sure to read client reviews and the features of the system to determine the viability. As artificial intelligence improves, you can expect an increasing number of vendors to offer these tools.

2. Monitor Behaviour Analytics

It’s vital to monitor and analyze the behavior data of your website users. Therefore, you’ll need to create a user profile and profile them. Then, you can flag deviations from standard behavior and spot fraudulent transactions.

Furthermore, you can use statistical and machine learning techniques to detect unusual patterns that could signify fraudulent activity. An excellent machine learning algorithm can quickly uncover questionable behavior.

3. Collaborative Intelligence

Participate in industry forums and share threat intelligence with other organizations to stay informed about new fraud tactics. This helps all businesses combat fraud at a higher level of efficiency.

Therefore, multiple businesses can build up a large database of best practices to reduce the instances of fraud in the industry. This is an area where businesses should not compete but collaborate to get the best outcome.

4. Monitor Location Data

It’s a good idea to track the geolocation data of your customers to ensure transactions avoid high-risk locations. However, you need to be transparent about your location collection strategies. You also need to adhere to the top location data compliance requirements.

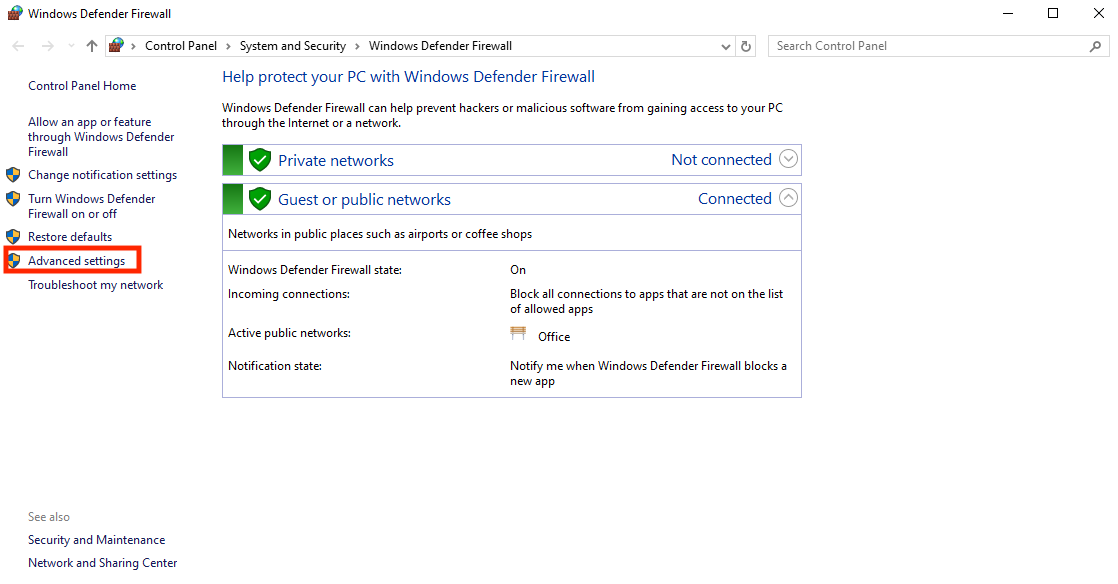

You’ll need to find an IP geolocation API to convert IP addresses into geolocation data. This ensures that you’re able to monitor customer locations. Then, you can feed this data into a machine-learning algorithm to spot questionable transactions.

Does Your Website Need Digital Fraud Protection?

Yes, every website needs some form of fraud protection to ensure you keep customer payment details safe. Ideally, every transaction on your website will be authentic. However, in practice, this isn’t always possible because scammers use many advanced techniques.

Therefore, you need to tilt the odds of success in your favor with the use of online payment fraud detection. Apply some of the techniques in this article to improve the security of your website and make it a more attractive destination for digital shoppers.

Do you want to track IP addresses to detect fraudulent activity? Then, you should turn to geoPlugin for an accurate IP geolocation tool. We specialize in turning IP addresses into geolocation data that you can trust.

So what are you waiting for? Start using geoPlugin today and see results!